The investment world has plenty of not very insightful sayings that somehow stick around, like…

“Pigs get fat, hogs get slaughtered.”

Or “never confuse brains for a bull market.”

The “democratization” of private investing prompts us to ask another classic, “if it’s such a great investment, why are they letting you/me in?”

This is a great question to ask anytime you’re pitched an investment. Sometimes a new company just needs some additional capital to pursue their dream, but it’s important to try to understand motivations.

When it comes to private markets, we can’t help but have a bit of a cynical view.

Most obviously, if we “follow the money,” fee compression has been a powerful trend in the investment industry (which we applaud), but “alternative” investments (like private equity, private credit, and hedge funds) still charge much higher fees and often charge performance fees, too.

We know that fees eat directly into the net returns that investors receive and therefore they should be scrutinized, but there are times when they’re well worth it.

Renaissance Technologies, for instance, is probably the most successful hedge fund of all time. Their fees are believed to be 5% annually plus a 44% performance fee. Ouch, but if we could join, we would in a heartbeat; Renaissance had a multi-decade run of 37% annualized returns after fees.[1]

So, we don’t want to disqualify an investment opportunity just because of fees if the results are there, but incentives need to be carefully aligned.

Private asset managers usually only charge management and performance fees when they have made investments and “put the money to work,” rather than charge you for the privilege of having your cash in their bank account. This is a well-intentioned design, but it can create a moral hazard, whereby an investment manager’s concern might be getting cash invested so they can run the till rather than being judicious and disciplined in scrutinizing investment opportunities.

The higher levels of fees that these more expensive private asset funds can generate are pretty well known, but please stay with us as we take a few steps down our Cynicism Trail.

After years of low interest rates and rising valuations, we fear that much of the easy juice has been squeezed from private equity, and in order to keep the music going, PE firms may be searching for new investors and fresh money to sluff off their old investments upon.

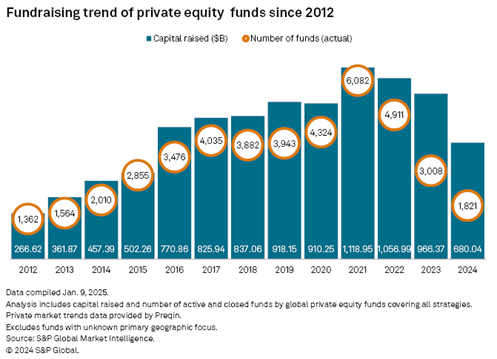

As you can see from the graph below, 2024 was the weakest year of private equity fundraising in nearly a decade and followed several consecutive years of decline in both the number of funds and total capital raised.[2]

An innocent explanation for this slowdown could be that the classic private asset investors like endowments, pensions, and sovereign wealth funds have reached their target allocations and are no longer significant buyers. We think some macroeconomic factors are at play as well.

If you have looked at purchasing real estate in the past few years, you likely have experienced some sticker shock at how much more expensive mortgages are because of higher prices and higher interest rates. A similar phenomenon has been happening in private equity. McKinsey estimates that valuation multiples for private equity deals have risen about 20% since 2019, but borrowing costs are also higher.[3]

Very basically, when interest rates are low, companies can do more with less because they can borrow money inexpensively to help support and grow their operations. When done correctly, borrowing (i.e. leverage) can be a very valuable tool, but it is a double-edged sword. After many years of low interest rates, the increase in interest rates we have seen in recent years—impacting everything from bank loans to leases to accounts payable—constricts how much money can flow through to the bottom line.

Given that many private equity firms use both cash and borrowed money to make their investments, these firms are facing a similar situation to home buyers where higher prices and higher interest rates mean a more challenging environment for attractive deals.

Basically, the math might not be mathing like it used to.

However, if more than $1 trillion of new money is going to be flowing into private market investing each of the next five years, investment managers may have their hands forced, at least if they want to get paid.[4]

While there are differences, Special Purpose Acquisition Companies (SPACs), which ran rampant during the COVID years, have similarities to private equity. SPACs are publicly traded “blank check” companies formed to buy a private company, thereby bringing it to the public market. If SPAC sponsors cannot identify a target company before a predetermined deadline, the money is returned to shareholders and the SPAC closes. Sound familiar to fund managers who are clearly incentivized to put money to work?

Unfortunately, SPAC investors have generally had disappointing returns. The Indxx SPAC & NextGen IPO Index is down about 35% since its inception in April 2020 and is down more than 50% from its peak in February 2021.[5] University of Florida Professor Jay Ritter published a study showing dismal performance by SPACs after merger announcements with negative one-year returns in all but one year since 2012.[6]

We are not suggesting that every acquisition of a company is value destructive, but we know that bidding wars are more common in competitive markets and overpaying immediately lowers your potential return.

Just as mutual funds can have varying performance, we expect that private asset managers will also have a wide range of results. Given the complexity of the transactions and the difficulty of getting out (as we’ll discuss in our next couple of posts), we think identifying a good manager will be especially important for private market investors.

If you have any questions about this blog, or other questions about your finances, please contact Blue River Capital Management at 503.334.0963 or at info@brcm.co.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss. Blue River Capital Management does not offer tax or legal advice. Results are not guaranteed. Always consult with a qualified tax professional about your situation.

[1] https://ofdollarsanddata.com/medallion-fund/

[2] https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/1/global-private-equity-fundraising-sinks-for-3rd-straight-year-87110906#:~:text=Private%20equity%20funds%20worldwide%20secured%20$680.04%20billion,since%202015%2C%20when%20it%20was%20$502.26%20billion.

[3] https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

[4] https://www.blackrock.com/ca/institutional/en/insights/private-markets-outlook#:~:text=Industry%20estimates%20project%20private%20markets,than%20%2420%20trillion%20by%202030.&text=Here%20are%20a%20few%20trends,demand%20for%20long%2Dterm%20capital.

[5] https://www.indxx.com/indices/thematic-indices/indxx_spac_&_nextgen_ipo_index

[6] https://site.warrington.ufl.edu/ritter/files/IPOs-SPACs.pdf