We have used our last blog posts to talk about how widely stock returns can vary year-to-year and how adding bonds—where the US 10 Year Treasury bond and the S&P 500 are uncorrelated—shows the value of diversification through slightly lower average annual returns, but a greater reduction in portfolio volatility.

What if we add another asset? Don’t worry, we’re not going to go down a total rabbit hole, but we think it’s interesting and surprising what happens when you add another asset, even if it’s highly volatile.

In our portfolio of S&P 500 stocks and 10-year US Treasury bonds, we have some volatility dampening benefit from our bond position, but maybe we want an opportunity to enhance our potential return.

Emerging markets are a classification of countries that typically have lower per capita incomes and living standards than we experience in the US or other major, developed economies, but that are growing in that direction. Our neighbors to the south, Mexico, are an example of one such developing/emerging economy. Others can be more surprising, like South Korea still being considered an emerging market.

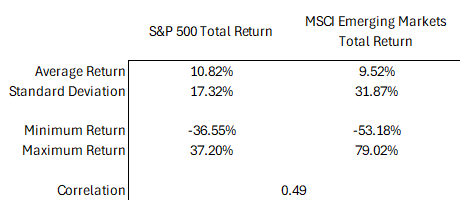

The stocks from emerging market countries are much more volatile than the S&P 500 going back to 1988[1],[2]:

If you were invested in emerging markets over the past 30-plus years, you have experienced some blissful years as well as some miserable ones.

The key for investing and portfolio management is the correlation of 0.49 between the S&P 500 and emerging market stocks (and a negative correlation between emerging markets and the US 10 Year Treasury).

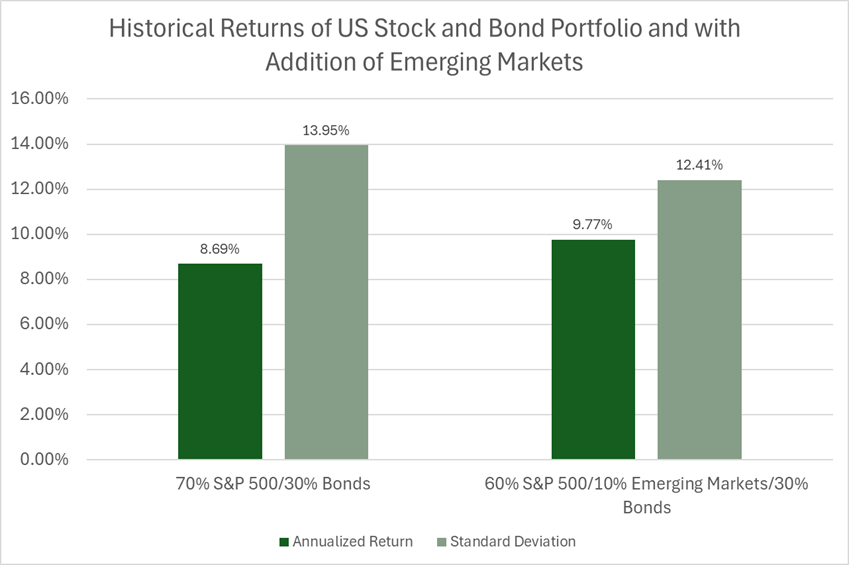

Here is what would have happened if, instead of a portfolio of 70% S&P 500 stocks and 30% US 10 Year Treasury bond, you had shifted 10% of the portfolio from the S&P 500 into the emerging markets index:

Perhaps we are nerds (we are), but we love this chart. How is it that adding volatile emerging market stocks to a portfolio both increased average returns and decreased volatility?

While this can seem like magic, these are some of the potential benefits of a carefully designed investment portfolio that incorporates assets that move differently than one another. Of course, there is no magic bullet and portfolios can still decline even when well diversified, but over time it can yield superior risk-adjusted returns.

If you have any questions about this blog, or other questions about your finances, please contact Blue River Capital Management at 503.334.0963 or at info@brcm.co.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss. You cannot invest directly in indexes. Blue River Capital Management does not offer tax or legal advice. Results are not guaranteed. Always consult with a qualified tax professional about your situation.

The S&P 500 Index represents a sample of 500 leading companies in leading industries in the U.S. economy and considered a leading gauge of the U.S. Equities Market. The S&P 500 index focuses on the large-cap segment of the market, however, since it includes a significant portion of the total value of the market, it also represents the market.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity performance in the global emerging markets. Investments in emerging markets can be more volatile. The normal risks of investing in foreign countries are heightened when investing in emerging markets. In addition, the small size of securities markets and the low trading volume may lead to a lack of liquidity, which leads to increased volatility. Also, emerging markets may not provide adequate legal protection for private or foreign investment or private property.

International investing involves a greater degree of risk and increased volatility. Changes in currency exchange rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Some overseas markets may not be as politically and economically stable as the United States and other nations.

[1] Data from YCharts and NYU Professor Aswath Damodaran. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

[2] All return figures are geometric means