People often refer to stocks having an average return in the high single digits and use that as a guide of what to expect in the future. However, in addition to the past being no guarantee or reliable indication of what the future will look like, there’s another complication: stocks have very rarely had “average” years.

Using data provided by New York University’s “Dean of Valuation,” Professor Aswath Damodaran, since 1928, the S&P 500’s average compound total return (including dividends received) is 9.8%. Interestingly, the simple arithmetic average is 11.66%[1].

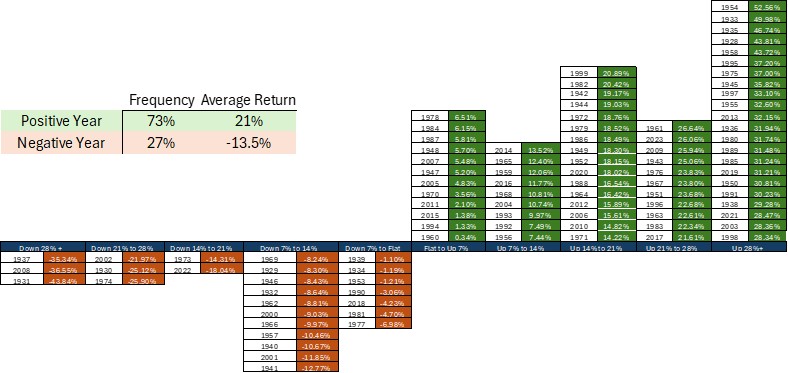

Statistically, the 11.66% figure would be our base case prediction of the annual total return of the S&P 500, but in the nearly 100 years of data, the S&P 500 has only had five years where the return was within 1% of the average (and there have only been two years where the S&P 500 total return was within 1% of the geometric average of 9.8%).

While averages are a convenient way to think about investing, history—and likely the future—is far messier than that.

Over the past 96 years, the S&P 500’s total return has been positive 70 years, or about 73% of the time. When the return has been positive, the average is 21%! Of the 26 years with negative returns, the average is -13.5%. Amazingly, there have been almost as many years with returns greater than 28% (22 times) than negative (26).

So, if the year-to-year dispersions of stock market returns vary so significantly, how do we make sense of it over time?

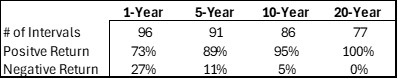

Instead of looking at single year returns, we can zoom out slightly and look at rolling intervals. When we do so, we can see that over longer time frames, the S&P 500’s return has been positive more frequently.

Along with greater “win rates”—intervals with positive returns—over longer time frames, the range of outcomes has also narrowed, and this is what we encourage long-term investors to focus on.

And importantly, over the 77 observed 20-year rolling intervals, the average return has been within 2% of the long-term average of 9.8% nearly 40% of the time. So, if you can afford to ride out the volatility, and can stomach the bumps, long-term investors have been rewarded with attractive returns and we expect this relation of risk (volatility) and reward to persist.

For investors who are less comfortable with volatility or would risk having their lifestyle impaired by significant declines in their portfolio, adding less risky investments (like bonds) can smooth out the ride. We’ll be writing more about this soon!

[1] The arithmetic average is a simple average of all the values in a series, but a geometric average multiplies the numbers in a series and then takes the nth root, which makes it a better measure for multiplicative changes like compounding growth. For example, imagine over three years the market returns +5%, +5%, and then -5%, the arithmetic mean would be (5+5-5)/3 = 1.67%, the geometric mean would be calculated as (1.05*1.05*0.95)^(1/3) – 1 = 1.55%.

If you have any questions about this blog, or other questions about your finances, please contact Blue River Capital Management at 503.334.0963 or at info@brcm.co.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. Investing involves risk, including risk of loss. Blue River Capital Management does not offer tax or legal advice. Results are not guaranteed. Always consult with a qualified tax professional about your situation